Fund3 invests in secured loans to middle-market real estate developers creating or preserving attainable housing

SEVERE SHORTAGE OF ATTAINABLE HOUSING

Attainable housing is unsubsidized, profitable housing developments that meet the income needs of between 80 – 120% of the median income of an area.

Largest segment of undersupply in the U.S. housing market.

MIDDLE MARKET DEVELOPERS ARE UNDER-BANKED

Developers and builders who have outgrown ‘friends-and-family’ capital but remain below the radar of larger institutions.

Highly skilled at navigating regulatory and economic challenges associated with attainable housing.

YELLOWSTONE IS IN AN ADVANTAGED POSITION TO CAPITALIZE

Yellowstone has assembled a team with a broad range of expertise and robust network of industry relationships.

Yellowstone’s TECHO lending platform provides consistent access to deal flow.

Developers seek out Yellowstone for leadership on capital markets and construction.

Residential real estate credit provides stability & opportunity

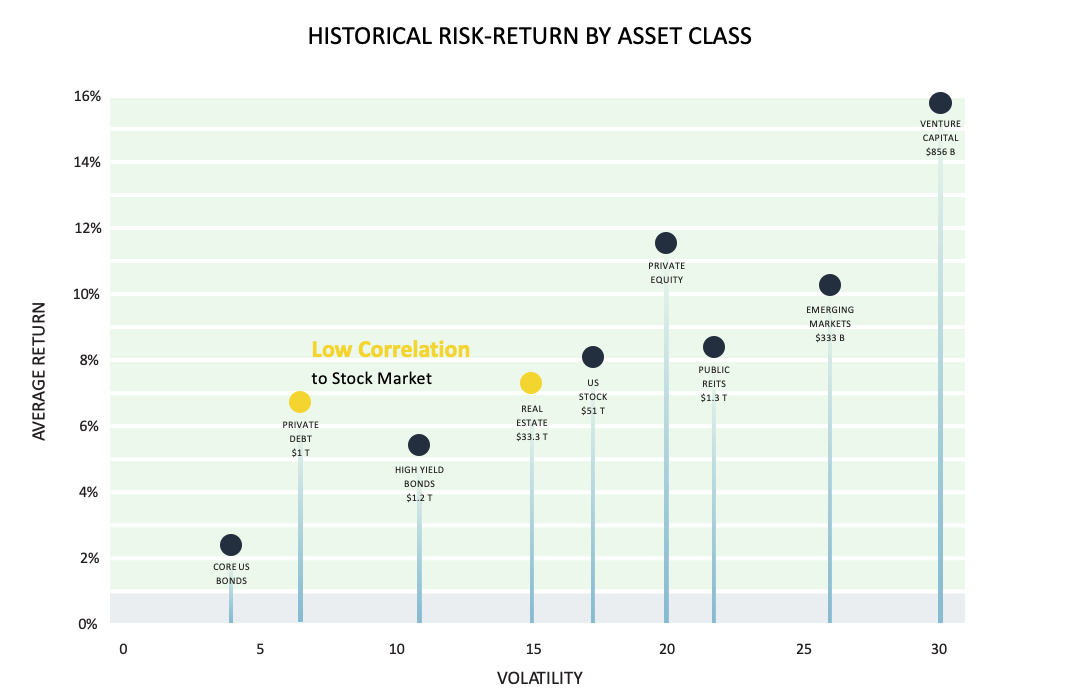

”Fund3” offers investors access to the benefits of private debt in the housing market – stable income, economic returns that are historically less correlated with the stock market, and downside protected by U.S. dollar-denominated, real estate collateral.

Housing is the “ultimate” essential service

Over the last decade, the housing sector went from ‘unloved’ by many investors to proving to be one of the more resilient sectors of the overall economy.

Demographic demand trends combined with persistent undersupply, accelerated by COVID-19, will continue to provide a favorable investment backdrop that will outweigh any residual distress that may exist as the economy reopens.

Yellowstone is well-equipped to capitalize on market tailwinds through a carefully executed, market-specific approach focused on financing experienced real estate developers improving communities and neighborhoods with critical housing supply deficits.